Worakorn has been in commercial bank business for more than 15 years working in the development of banking operations and processes for such products as deposit, loan, currency exchange, treasury, custodian and trade financing. His last position was First Vice President at Thanachart Bank, in charge of lending and transaction management and processing. He received his Master of Science in Economics from Murray State University, Master of Engineering (Manufacturing) from Portland State University, and Bachelor of Science in Computer Science from Mahidol University.

Our Story

Pioneering ASEAN debt crowdfunding platform. Time to get to know us better.

What is Investree?

Investree is an ASEAN-based financial technology company with one simple mission: empowering SME with new access to capital. We aim to make credit much more accessible and affordable for SME as a licensed Crowdfunding Platform under the Securities and Exchange Commission of Thailand.

We are driving financial inclusion through the digital space.

Approved by SEC

Helping Each Other Achieve Financial Freedom

Thailand is a nation well-endowed with highly promising natural, capital, and economic potential. But similar to other countries, the financial infrastructure and regulatory requirements often leave gaps in financial services for small companies and entrepreneurs.

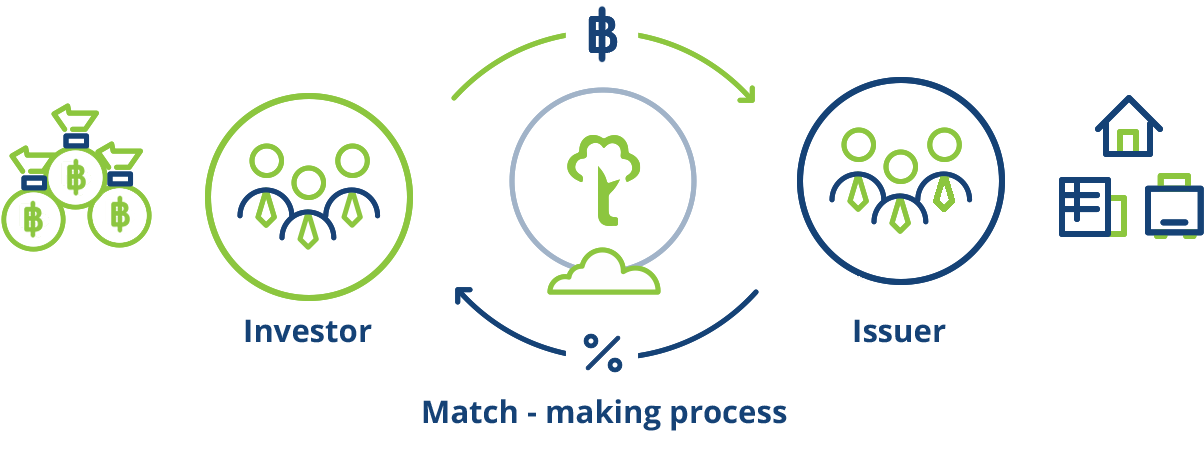

Technological development to today has provided us with the tools to democratize financial services in an efficient and sustainable manner. Along this manner, Investree is working with local partners to develop and apply technological innovation to the oldest financial product in the world which is loans. At its core, investree aims to provide direct links between savers and SMEs that need financing within an transparent ecosystem of trust. Once we remove the hefty intermediation process, what we end up with is a world where savers are provided access to new financial products while qualified small companies have better access to flexible and economical financing that suit their needs.

As a pioneering company, our working principles is to create trust, enhance integrity, innovation and professionalism that benefits stakeholders under the banner of the sharing economy.

Regards

Worakorn Sirijinda

How do we make our profits?

In line with Investree's goals of ensuring openness, security and ease of access, we feel it is imperative to be transparent with everything including our fees.

At Investree we charge issuers and investors pre-defined fees for accessing our credit and crowdfunding services.