Investree and T Broker Collaborate to Enhance SME Credit Access Amid Rising Interest Rates

Investree and T Broker are teaming up to bolster SMEs' financial muscle and shield them from business risks. Amidst the tough lending landscape and climbing interest rates, this alliance seeks to open up new financing opportunities for SMEs.

Natsuda Bhukkanasut, Investree Thailand's co-founder and CEO, said “Thailand's credit market is currently facing tightening constraints. Despite growing demand for business loans from the gradual economic recovery and the return of tourism, SMEs that are seeking loans for their working capital and increased production are still finding it hard to get loans from financial institutions due to stringent lending criteria following the Bank of Thailand's six interest rate hikes.”

"The tourism-driven economic recovery has certainly put business loans back in demand as the service sector slowly comes back to life. However, the same is not true for the manufacturing sector as reflected in the recent export number. The Thai economy, now more than ever, is going to be heavily relying on domestic consumption. We really need to tackle the liquidity issues plaguing businesses, particularly the SMEs,” said Natsuda.

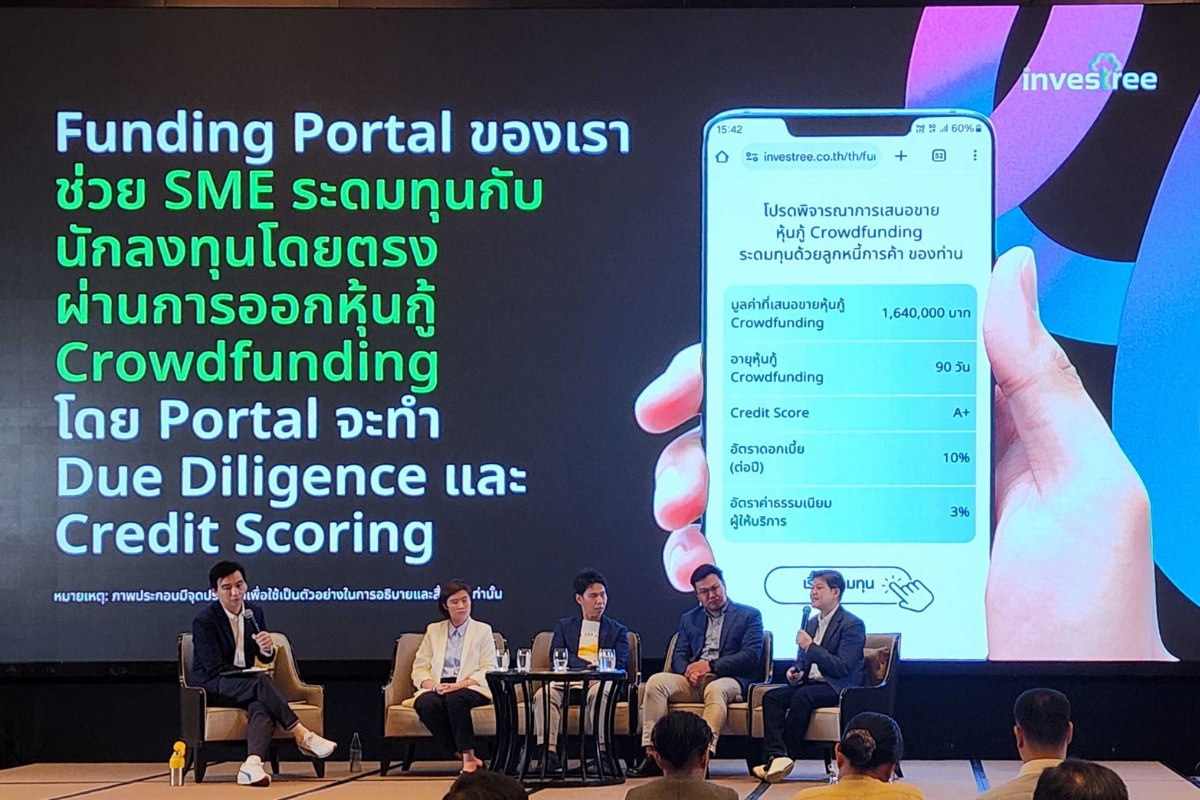

The need for small business financing is reflected in Investree’s growth. “Investree’s funding portal has seen significant growth since its inception. Our platform has been used by 81 SMEs, raising over 1.5 billion Baht since we launched. In terms of growth, SME’s funding grew threefold in 2022, and almost threefolds for the first quarter of 2023 when compared to the same period in 2022.

Worakorn Sirijinda, Co-Founder and COO of Investree Thailand, announced a new partnership with T Broker, a subsidiary of Thanachart Capital Public Company Limited, marks a significant move to support SMEs in accessing capital, enhancing financial capabilities, and improving risk management. “This partnership will benefit both Investree and T Broker’s customers, opening doors for entrepreneurs to propel their businesses forward despite a challenging lending environment.”

Suwimol Boonnak, CEO of T Broker Company Limited, a subsidiary of the well-established Thanachart Group, known for its brokerage service that covers a variety of investment and insurance products, said with our T-Advisor network, which comprises over 5,000 professionals, we aim to connect our customers who are looking for financing with Investree’s funding solution.

“The partnership will help broaden T Broker's client base from individual to corporate, particularly, the small and medium enterprises (SMEs). We will focus on leveraging our broad service portfolio and deliver comprehensive financial solutions tailored to meet specific needs of our individual client.”

Chanita Khayantruad, T Broker’s Managing Director, further emphasized, T Broker stands ready to grow the corporate segment, providing tailored funding solutions for those seeking financial assistance. We also intend to supplement and strengthen the financial capabilities of our current business customers, particularly those who already have our insurance policies. Our collaboration with Investree is a testament to our commitment, promising our customers an enhanced, comprehensive suite of services designed to meet their evolving needs."

Natsuda shared insights into the small and medium-sized enterprise (SME) business trends, "For the second half of 2023, we will continue to see a resurgence in several businesses, notably those that have gained from the nation's reopening and the influx of tourists. Despite these positive signs, uncertainty still looms over the economic forecast, driven by anticipated policy shifts and the incoming government. Simultaneously, entrepreneurs are grappling with escalating costs, a factor that could significantly affect SMEs. Addressing these challenges promptly and efficiently stands as a critical task for the government,"

"We are committed to being a viable funding alternative for SMEs. However, we cannot go this alone. Given the rise in demand for business loans and crowdfunding issuance as well as the high risk that comes with such investments, it's imperative for us to exercise discretion when choosing potential issuers, ensuring they possess the requisite capabilities” Natsuda concluded.

Since SEC’s crowdfunding inception, over 800 SMEs have used the platforms to raise over 7.7 billion Baht to fund their business operations. For the first four months of 2023, 429 companies have raised a total of 2.1 billion Baht using Funding Portals or Crowdfunding Platforms. Investree’s market share is approx. 20%, up 4% from previous year's market share. The current average return on investment is approx. 11.5%. Investree remains committed to building a platform that caters to investors and as an additional option for SME entrepreneurs in enhancing the strength and potential of their businesses.

SMEs and investors seeking advice on credit and investment can go to this website www.investree.co.th.